ПЕРСПЕКТИВЫ РАЗВИТИЯ РОССИЙСКОГО РЫНКА ПРИРОДНОГО ГАЗА

НА АЗИАТСКО-ТИХООКЕАНСКОМ НАПРАВЛЕНИИ

Научная статья

Шаховская Л.С.1, Тимонина В.И.2, *

1 ORCHID: 0000-0002-3700-2435;

2 ORCHID: 0000-0003-2344-6497;

1, 2 Волгоградский государственный технический университет, Волгоград, Россия

* Корреспондирующий автор (timonina.vika96[at]yandex.ru)

Аннотация

Многие страны АТР выходят на новую траекторию развития в энергетическом плане. Так, стремление Японии к новому позиционированию в мировой политике связано, прежде всего, с возвышением Китая, что создает новую ситуацию в Восточной Азии. Современная ситуация объясняет важность Японии иметь надежных партнеров для сотрудничества на мировом энергетическом рынке. Россия, в свою очередь, «ощущает» возрастающее давление геополитического вызова XXI века – развитие Дальнего Востока и Восточной Сибири. Таким образом, Россия и Япония обладают тем, в чем нуждается другая сторона и что может быть взаимно «обменено». Япония для России – важный фактор развития восточных регионов, Россия для Японии – существенный фактор в формировании благоприятной международной экономической среды. Оживление энергетического диалога двух стран вполне возможно, но теперь для этого потребуются эффективные меры. Этому и посвящена статья: в первой части рассматриваются основные черты энергетической политики Японии, во второй – исследуются направления сотрудничества с Россией в области нефти и газа.

Ключевые слова: СПГ, Япония, Россия, сотрудничество, перспективы.

PROSPECTS FOR DEVELOPMENT OF THE RUSSIAN NATURAL GAS MARKET

IN THE ASIA-PACIFIC DIRECTION

Research article

Shakhovskaya L.S.1, Timonina V.I.2, *

1 ORCHID: 0000-0002-3700-2435;

2 ORCHID: 0000-0003-2344-6497;

1, 2 Volgograd State Technical University, Volgograd, Russia

* Corresponding author (timonina.vika96[at]yandex.ru)

Abstract

Many APR countries are moving towards a new energy trajectory. Thus, Japan ‘s desire for a new positioning in world politics is primarily linked to China ‘s rise, which creates a new situation in East Asia. The current situation explains the importance of Japan having reliable partners for cooperation in the world energy market. Russia, in turn, “feels” the increasing pressure of the geopolitical challenge of the XXI century – the development of the Far East and Eastern Siberia. Thus, Russia and Japan possess what the other side needs and what can be mutually “exchanged.” Japan for Russia is an important factor in the development of the eastern regions, Russia for Japan is a significant factor in the formation of a favorable international economic environment. A revival of the energy dialogue between the two countries is possible, but now it will require effective measures. The article is devoted to this: the first part examines the main features of Japan’s energy policy, the second – explores the areas of cooperation with Russia in the field of oil and gas.

Keywords: LNG, Japan, Russia, cooperation, prospects.

Introduction

The gradual strengthening of ties between Russia and Japan reflects modern trends in the development of a polycentric world structure, which is largely the result of the response of countries to new global challenges and threats. Every year, countries are gaining more and more weight on the world stage and acting as a counterweight to the established and outdated structure of the distribution of economic priorities and forces, including in the field of energy.

The object of this work is the economic component of the energy market of Russia and Japan.

The subject of the study is national energy strategies, fuel and energy complexes, as well as energy cooperation as a means of ensuring energy security.

Research problems:

- assessment of the current state of the fuel and energy complex of countries and key areas of their energy strategies;

- comparative analysis of energy policy implementation directions;

- study the prospects of cooperation between Russia and Japan in the field of energy development.

In January 2017, Japan imported gas from the United States for the first time. Unlike gas from Australia, gas from the United States can be resold on the market. However, liquefied natural gas in Japan is traded under long-term contracts that are related to crude oil prices, so U.S. gas is relatively expensive for Japan. It can be concluded that the agreement between “Toshiba” and “Freeport LNG Development” on the liquefaction of 2.2 million tons of gas for 20 years will remain unsold, as losses could amount to more than 1 trillion yen (about 8.82 billion dollars).

At the conference “Gastech 2017,” many participants from the American side expressed the opinion on the continuation of cooperation with Japan in the development of energy: “One of the ways to balance protectionist trends of the USA – to buy more LNG from the country, which will reduce the trade deficit and protect the own economy of Japan,” – said O. Simos [9].

“Jordan Cove LNG” president E. Spomer also expressed the view that the US is interested in developing energy exports to Japan.

At the same time, Japanese buyers are slow to buy American LNG, citing that it is expensive compared to the gas Japan receives under existing contracts. Thus, the gas analyst of the Institute of Energy Economics Hiroshi Hasimoto earlier wrote that “at the moment the supply of LNG from the USA to Japan does not seem attractive in terms of price” [8].

According to some reports, LNG, which is delivered to Japan from “Sabine Pass”, Louisiana, in January 2017 cost over 12 dollars/million British Thermal Units (BTUs). This is due primarily to high transportation costs, the amount of payment for passage through the Panama Canal, etc.

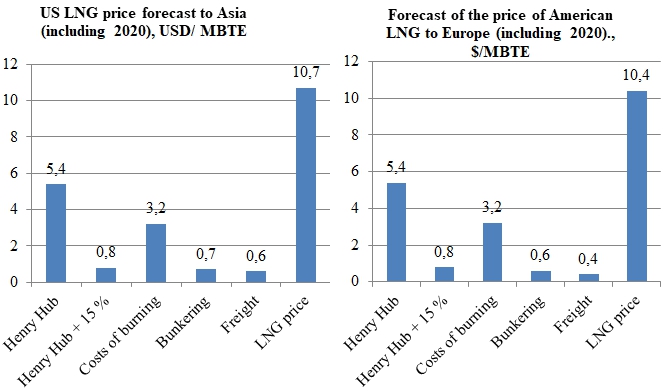

It is difficult for American LNG companies – projects to abstract to price conditions in the markets of Europe and Asia. Europe was counting on LNG imports from the US, which was supposed to lower gas prices and form a new supplier in an alternative to Russian gas. However, assessing the results of the first deliveries from “Sabine Pass” field (USA) to Europe proved to be unprofitable (approximately -0.6 dollars/MBTU). According to the Vygon Consulting Group, deliveries amounted to only 10% (i.e. 0.4 million tons) of the total volume, half of the gas production was delivered to Latin America (margin – 2 dollars/MBTU). What are the price risks for buyers in Europe and Asia when buying gas from the United States?

When purchasing gas at current Henry Hub prices, the price includes transportation charges (another 15% from Henry Hub), gas liquefaction (additional 2.25 – $3/MBTU), gas freight and technological losses.

Vygon Consulting assessed the prospects of American LNG including 2020. According to them, even at the price of 3.6 dollars/MBTU, taking into account the increase in the cost of freight and liquefaction, the gas will not remain profitable for consumers in Europe and Asia. According to foreign experts, direct competition between Russian and American LNG will not arise in the next decade (see Figure 1).

Fig. 1 – US LNG Supply Price Forecast [5]

It is worth noting that cooperation with the Russian Federation is one of the main directions of Japan’s policy of diversifying the supply of energy raw materials. As I.L. Timonina notes [4]: “the share of Russian gas reaches 10% of Japan’s total imports (10 years ago it was about 4%). For the Russian side, in the context of a certain reorientation of the entire system of foreign economic relations from the West to the East, diversification of hydrocarbon supplies (including diversification within the region where China becomes the main consumer) is also beneficial”.

On the Japanese side, interest in Russia can be explained by many reasons. A.V. Belov describes the most relevant: firstly, Japan’s dependence on oil and gas in the Middle East (about 60%) is considered too high, which dictates the need to diversify suppliers. Secondly, access to Russian energy is considered in Japan as a way to reduce purchase prices and ensure stability of supply. Thirdly, Russia represents an important market for almost all types of Japanese energy technologies and equipment, from power plants to lithium batteries [2].

Estimated by J.D. Brown, improving relations with Russia was one of the solutions to the problem of the “northern territories”: firstly, this is a de facto softening of the Japanese position compared to the requirements of the four islands to the position of “two plus alpha” (Togo); secondly, the proposed eight-point cooperation plan is intended to promote a positive atmosphere in bilateral economic relations, build trust and demonstrate the benefits of closer relations [3].

Cooperation between Russia and Japan

In April 2017, it became known that energy relations between Russia and Japan were moving to a new level, due to the development of the “Sakhalin-3” project. The project is planned to be launched in 2022. The implementation of the project will allow Japan to obtain gas 2.5 times cheaper than LNG in the world market. For example, “Japan Pipeline Development and Operation” (JPDO) and “Japan Russian Natural Gas” (JRNG) are developing a plan for the Sakhalin-Hokkaido gas pipeline, through which will be supplied gas in the amount of more than 20 billion cubic meters in a year. The length will reach 1.5 thousand km to Tokyo, the cost of such a project will be about 5.5 or 6 billion dollars (see Figure 2).

Fig. 2 – Sakhalin – Hokkaido – Tokyo Project Plan [7]

According “JPDO” experts, the construction of the gas pipeline will be beneficial for both sides: the project will be in high demand than planned (about 25 billion cubic meters of gas instead of 20 billion cubic meters). At the same time, these assumptions are based on the fact that Japan is the world ‘s largest LNG consumer, and it is possible that the purchase of gas on a long-term stable basis will lead to an increase in demand.

The profitability of the project is estimated by the ROE coefficient of more than 20%, and it is also expected not only to own financing by the consortium, but also to involve leading foreign enterprises, investors and credit institutions.

The resource base will be the fields of “Gazprom” – “Sakhalin – 3” project, the reserves of which are estimated at 1.4 trillion cubic meters, also raw materials base Japanese companies would like to see Eastern Siberia with reserves of 3.2 trillion cubic meters and Sakhalin-1 fields with 500 billion cubic meters. Discussions about gas procurement about the last two fields have been under way by companies for many years. Japan is currently buying about 80% Russian gas from the “Sakhalin-2” field.

According to “Japan Russian Natural Gas”, if the transportation is 25 billion gas in the form of LNG, the cost of liquefaction will be about 18 billion dollars. Therefore, the price, taking into account the costs of transportation, liquefaction, degasification and delivery, would be 5 dollars/ MMBtu, and the cost of pipeline gas is only 2 dollars/ MMBtu. According to experts, the income from transportation will be about 1.5 billion per year, operating expenses about 500 million per year, revenues about 1 billion dollars, net income about 670 million dollars. According to “Japan Pipeline Development and Operation”, the project has high profitability, which is confirmed by these financial indicators [6].

«Russian companies on the field of action»

A certain success in cooperation between Russian and Japanese companies is the signing of documents between the parties EEF-2019 the site. For example, “NOVATEK” announced a final investment decision on the “Arctic LNG-2” project for the development of a field and the construction of an LNG plant on the Gydan Peninsula. The project provides for the construction of 3 technological lines (TRAIN) on gravity-type bases (OGT). The capacity of each line is 6.6 million tonnes/year, i.e. the total capacity of the plant will be 19.8 million tonnes/year LNG. The launch of the first line is planned for 2023, the second line – for 2024, the third – for 2026. Capital investments for the launch of the project at full capacity are estimated at the equivalent of 21.3 billion dollars.

Japan is represented in the project through “Japan Arctic LNG”, a consortium of “Mitsui & Co” and “JOGMEC” that owns 10%. Participation in the”Arctic LNG -2″ also gives “Japan Arctic LNG” the right to purchase LNG on a long-term basis in amounts proportional to participation rates. As A. Novak noted: “If the Yamal LNG plant is put into operation with the participation of Japanese companies as contractors, the Arctic LNG-2 implemented with the participation of Japanese colleagues already as full partners” [10].

At the same time, Minister of Foreign Affairs of Japan T. Kono said that “the volume of investments of Japanese companies in the Arctic LNG-2 project will amount to 5 billion dollars” [10].

“NOVATEK” also expanded cooperation with “Saibu Gas” on LNG supply routes to Japan and the APR countries. In September 2019, the companies signed the basic terms of the agreement, which determine the interaction of the companies in this direction. The document specified the memorandum of understanding signed in 2018 concerning the optimization of LNG supplies to the APR countries through the use of the capacity of the Hibiki SPG Terminal in southern Japan. Together with the transfer LNG complex at Kamchatka, the Hibiki terminal will help to build an effective LNG supply system. In accordance with the basic terms of the agreement, “NOVATEK” and “Saibu Gas” plan to create a system that will include the sale of LNG and natural gas to end-users, the development of natural gas bunkers and electric generating capacities in Japan and the APR countries, and the construction and operation of a new LNG storage tank on the territory of the Hibiki SPG- Terminal. “Rosneft” also cooperates with Japanese partners. The company has extensive experience of cooperation with Japanese partners within the framework of the “Sakhalin-1” project and a number of other projects. As early as 1996 “Rosneft” attracted a group of foreign companies to the “Sakhalin-1” project, including Japanese SODECO with a 30% stake.

The accumulated oil production under the “Sakhalin-1” project has already reached 114 million tons, and 26 billion cubic meters have been delivered to consumers gas. The project continues to develop and in 2019 the shareholders decided to build their own SPG – a plant with a capacity of 6.2 million tons in De Castry. Thus “Rosneft” outlined the return to plans for the construction of the Far East LNG plant, which had previously been postponed many times, including the sanctions impact on the project. However, as a result, the decision to build was made.

The advantage of “Rosneft” is the geographical proximity of “Sakhalin-1” to Japan, which eliminates the need for complex logistics schemes with reloading SPG terminals. According to representatives of the company and experts, the launch of the Far East LNG SPG plant will take place after 2023.

Results

In modern conditions, in relation to the Russian energy sector (the imposition of sanctions by Western countries), export supplies to the EU are being reoriented to the countries of the Asia-Pacific region. Under these conditions, the Far East of Russia acts as a major oil and gas source that has advantages and opportunities to compete in the Asian market, using not only a favorable investment climate, but also the infrastructure developed today. The analysis showed that Russia is the largest supplier in the market of the countries of the Asia-Pacific region. Interest in Russian energy in the Asian market is constantly growing. This is due to Russia’s geographical position, high hydrocarbon reserves in the Far East, supply security, low political risks, etc. [1].

Conclusion

Thus, Russia ‘s cooperation with the APR countries consists in the development of energy resources using the innovative and investment potential of the leading APR economies – China, Japan, South Korea. The ideas of “interfacing” common strategies will allow to form fundamentally new geo-economic approaches to multilateral interaction in the long term. In case of a positive change in the dynamics of the situation in the world and in the APR, bilateral ties of strategic partnership can naturally lead to resuscitation of once-unopposed ideas both on the basis of traditional formulas and on the basis of new “geo-economic strategies”.

| Конфликт интересов

Не указан. |

Conflict of Interest

None declared. |

Список литературы / References

- Market peculiarities of natural gass: case of the Pacific Region [Electronic resource]/ L.S. Shakhovskaya, Е.S. Petrenko, А.F. Dzhindzholiya, V.I. Timonina // Entrepreneurship and Sustainability Issues. – 2018. – Vol. 5, No. 3 (March). – P. 555-564. – URL: https://doi.org/10.9770/jesi.2018.5.3(11) (accessed: 03.06.2020).

- Белов, А.В. Перспективы российско-японского сотрудничества в области энергетики / А.В. Белов // Японские исследования. 2016. №1 [Электронный ресурс]. URL: http://japanjournal.ru/images/js/2016 /js_2016_1_32-46.pdf (дата обращения: 03.06.2020)

- Brown J.D.J. Japan’s Russia Policy: Looking Back on 2016 and Ahead to 2017. [Online]. Available: http://www.theasanforum.org/japans-russia-policy-looking-back-on-2016-and-ahead-to-2017/ (accessed: 03.06.2020)

- Тимонина, И.Л. Россия – Япония: реальный потенциал экономического взаимодействия / И.Л. Тимонина // Японские исследования. 2016. №1 [Электронный ресурс]. URL: http://www.japanjournal.ru /images/js/2016/jspdf (дата обращения: 03.06.2020)

- Газ рассеивается над Атлантикой [Электронный ресурс]. URL: http://www.kommersant.ru/doc/3261133 (дата обращения: 03.06.2020)

- Япония рассчитала дорогу к России [Электронный ресурс]. URL: http://www.kommersant.ru/doc/3248653 (дата обращения: 03.06.2020)

- Япония оценила строительство газопровода Сахалин-Хоккайдо в 6 млрд. долларов [Электронный ресурс]. URL: http://edo-tokyo.livejournal. com/5796034.html (дата обращения: 03.06.2020)

- Японские компании не спешат покупать СПГ в США из-за дороговизны [Электронный ресурс]. URL: http://www.finmarket.ru /news/4506493 (дата обращения: 03.06.2020)

- СПГ из США – благо для Японии, но не панацея [Электронный ресурс]. URL: http://www.vestifinance.ru/articles/82708 (дата обращения: 03.06.2020)

- В. Путин и С. Абэ плотно пообщались на ВЭФ-2019, но о конкретике не договорились. А для российско-японского бизнеса главной темой стал СПГ [Электронный ресурс]. URL: https://neftegaz.ru/ news/transport-and-storage/489283-v-putin-i-s-abe-plotno-poobshchalis-na-vef-2019-no-o-konkretike-ne-dogovorilis-a-dlya-rossiysko-yapo/ (дата обращения: 03.06.2020)

Список литературы на английском языке / References in English

- Market peculiarities of natural gass: case of the Pacific Region [Electronic resource]/ L.S. Shakhovskaya, Е.S. Petrenko, А.F. Dzhindzholiya, V.I. Timonina // Entrepreneurship and Sustainability Issues. – 2018. – Vol. 5, No. 3 (March). – P. 555-564. – URL: https://doi.org/10.9770/jesi.2018.5.3(11) (accessed: 03.06.2020).

- Belov A.V. Perspectives of Russian-Japanese cooperation in the field of energy / A.V. Belov // Japanese studies. 2016. №1 [Electronic resource]. URL: http://japanjournal.ru/images/js/2016/js_2016_1_32-46.pdf (accessed: 03.06.2020) [in Russian]

- Brown J.D.J. Japan’s Russia Policy: Looking Back on 2016 and Ahead to 2017. [Electronic resource]. Available: http://www.theasanforum.org/japans-russia-policy-looking-back-on-2016-and-ahead-to-2017/ (accessed: 03.06.2020)

- Timonina I.L. Russia – Japan: real potential of economic cooperation / I. L. Timonina // Japanese Studies. 2016. №1 [Electronic resource]. URL: http://www.japanjournal.ru/images/js/2016/js_2016_1.pdf (accessed: 03.06.2020) [in Russian]

- Gas dissipates over Atlantic. [Electronic resource]. URL: http://www.kommersant.ru/doc/3261133 (accessed: 03.06.2020) [in Russian]

- Japan calculated the road to Russia. [Electronic resource]. URL: http://www.kommersant.ru/doc/3248653 (accessed: 03.06.2020) [in Russian]

- Japan estimates construction of Sakhalin-Hokkaido gas pipeline at 6 billion dollars. [Electronic resource]. URL: http://edo-tokyo.livejournal.com/5796034.html (accessed: 03.06.2020) [in Russian]

- Japanese companies are slow to buy LNG in the US due to high cost. [Electronic resource]. URL: http://www.finmarket.ru/news/4506493 (accessed: 03.06.2020) [in Russian]

- LNG from the US is good for Japan, but not a panacea. [Electronic resource]. URL: http://www.vestifinance.ru/articles/82708 (accessed: 03.06.2020) [in Russian]

- Putin and S. Abe spoke tightly at the ВЭФ-2019, but no specifics were agreed upon. And for Russian-Japanese business the main theme was LNG. [Electronic resource]. URL: https://neftegaz.ru/news/transport-and-storage/489283-v-putin-i-s-abe-plotno-poobshchalis-na-vef-2019-no-o-konkretike-ne-dogovorilis-a-dlya-rossiysko-yapo/ (accessed: 03.06.2020) [in Russian]